As part of morphing from a straight “buy stock on buy days and sell at Profit Target” I’ve chosen to sell Cash Secured Puts (CSP’s) when a dividend date is not near. This is a more efficient way of entering a position or taking the PT profit without ever owning the stock.

At the end of this notice is part of my journal entry for this trade. Questions (or critiques!) are ALWAYS welcome. I include the journal notes to sort of document the changes occurring in my version of TtP-S.

| TtP-S | As of: 07/08/15 10:35 TtP-S Alert Display Format 2 Version 2.1 | |||||||

| Moderator Message (if any): Today’s Buys & Sells. Pete A | SPY | DIA | ||||||

| Previous Close | 208.02 | 177.63 | ||||||

| Current Price | 205.48 | 175.71 | ||||||

| Day Low | 204.92 | 175.25 | ||||||

| % Chg from Prev Close | -1.49% | -1.34% | ||||||

| Buy Day! | ||||||||

| (Based on low of the day) | ||||||||

| Today’s Buys/Sells | ||||||||

| Ticker | Buy Price | Buy Date | Profit Target | Sell Price | Sell Date | Profit Percent | Annualized RoI % | Current Position |

| QCOM | 60.50 | 2015-07-08 | 62.32 | – – | – – | – – | – – | Bought |

QCOM – 7/8/2015 Sell CSP

Wednesday, July 08, 2015

9:36 AM

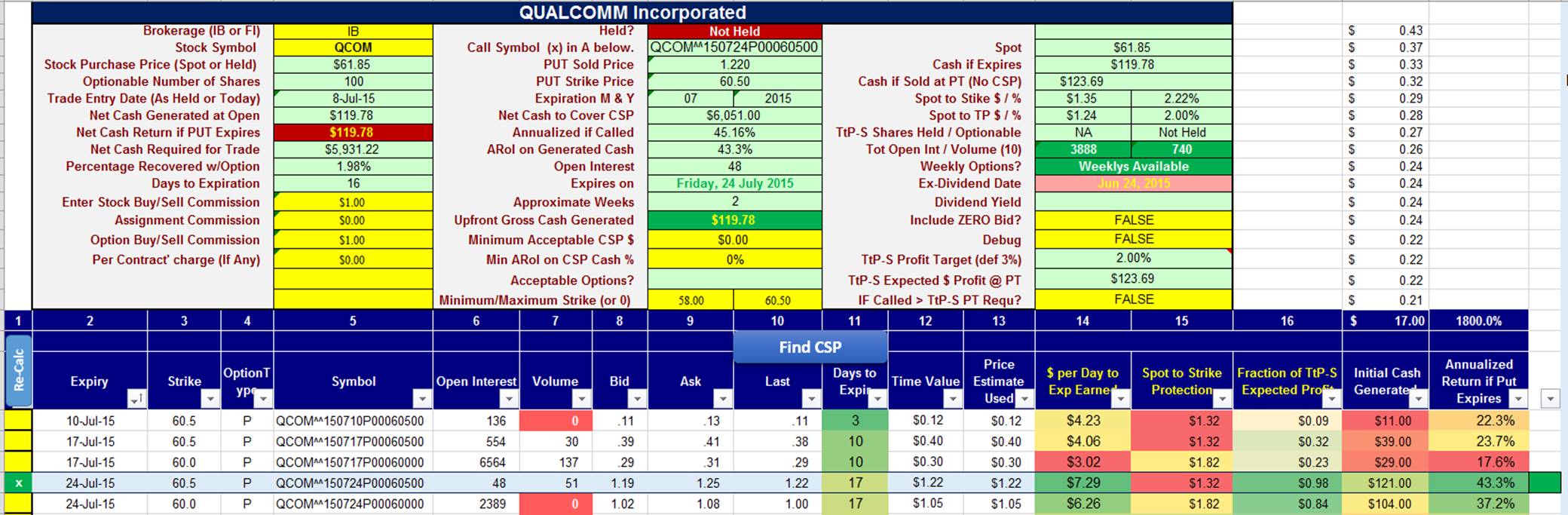

Logic is to get nearly the amount or better of a TtP-S Target while still setting the strike as far below current price as possible AND having as few days to Expiry as possible AND with an Annualized return as high as possible. This has $1.35 protection.

Here is the best balance I could find:

7/8/2015 9:38 AM – Screen Clipping

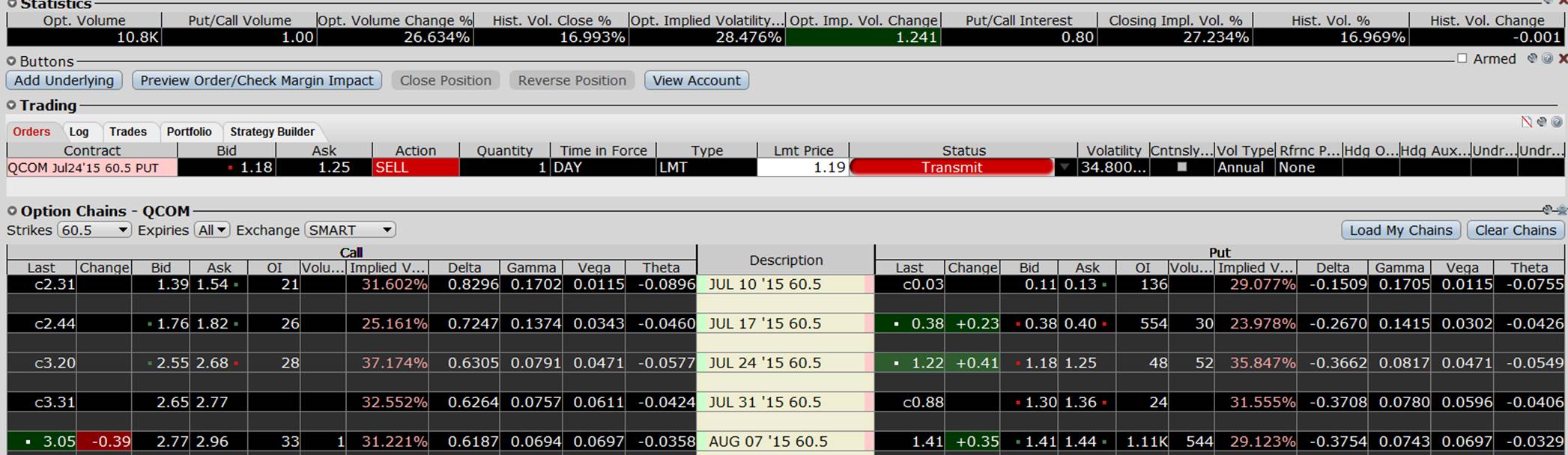

The current prices are:

7/8/2015 9:39 AM – Screen Clipping

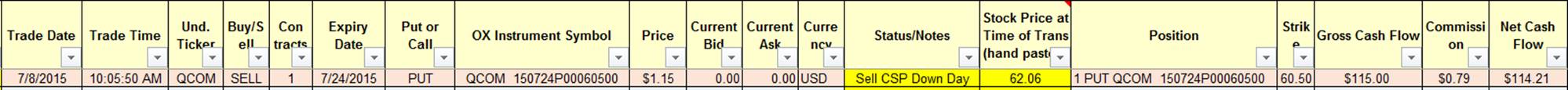

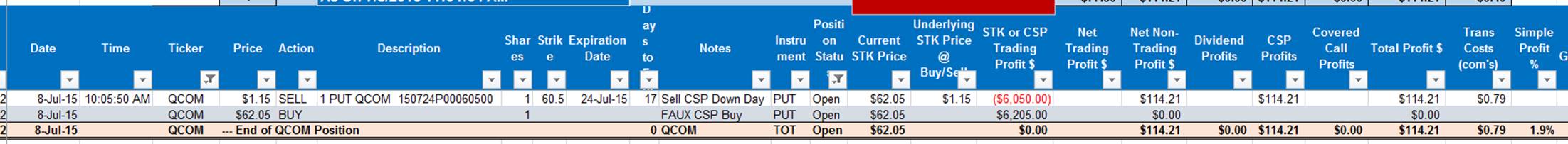

The actual trade wasn’t as good, as I tried for the mid price in the puts, of 1.22. Ended up with 1.15. Lesson is to take the lower price? But got more than the 1.18 at the lower end…no good lesson, I guess:

7/8/2015 10:09 AM – Screen Clipping

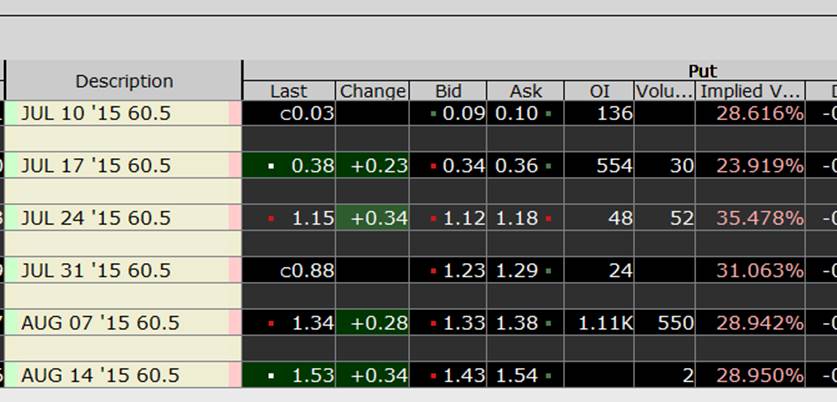

7/8/2015 10:11 AM – Screen Clipping

7/8/2015 11:05 AM – Screen Clipping