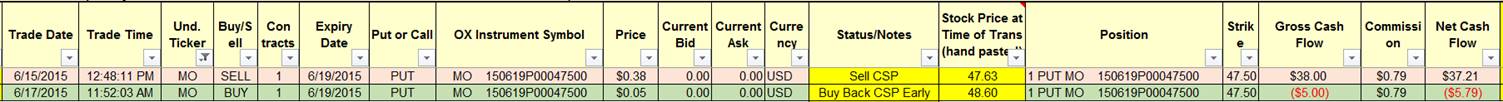

The sale data on MO looks WRONG!! But it isn’t. It was actually a CSP that I sold (instead of buying MO) and then bought back for a nickle this morning when the market jumped.

Actual transactions below. Return is calculated on the net proceeds from selling the CSP less the commission costs for the buy & sell based on the $4750 “secured” part of the CSP (100 shares times the Put’s Strike), all adjusted for the time held (2 days). A lot of explanation, but very little work to earn the $31.42, but not nearly as much as I MIGHT earn if the PT was reached on an actual buy.

| TtP-S | As of: 06/17/15 12:39 TtP-S Alert Display Format 2 Version 2.1 | |||||||

| Moderator Message (if any): Today’s Buys & Sells. Pete A | SPY | DIA | ||||||

| Previous Close | 210.25 | 179.21 | ||||||

| Current Price | 211.13 | 179.98 | ||||||

| Day Low | 209.36 | 178.49 | ||||||

| % Chg from Prev Close | -0.42% | -0.40% | ||||||

| NOT a Buy Day | ||||||||

| (Based on low of the day) | ||||||||

| Today’s Buys/Sells | ||||||||

| Ticker | Buy Price | Buy Date | Profit Target | Sell Price | Sell Date | Profit Percent | Annualized RoI % | Current Position |

| MO | 47.50 | 2015-06-15 | 48.57 | 47.50 | 2015-06-17 | -0.02% | 116.85% | Sold |

|